Start Up Savings

What are you saving for?

Whether it’s an emergency fund, a car down payment, or even a vacation, we want to help you get there faster. Way faster. With a top rate like our Start Up Savings1 offers, you’ll be saving without even thinking about it.

Yep. That’s an interest rate you can get behind. Reach your goals faster with big returns on balances up to $1,000.

You’ll start earning our highest rate on the very first dollar you deposit. That makes this account a great way to start your saving off right.

We want to help you build savings fast, so you’re free to make deposits anytime with this account. Although you won’t get an ATM card, you’ll get quick access to your money if you transfer to another account.

Be prepared for whatever life throws your way with this easy way to start and grow an emergency fund.

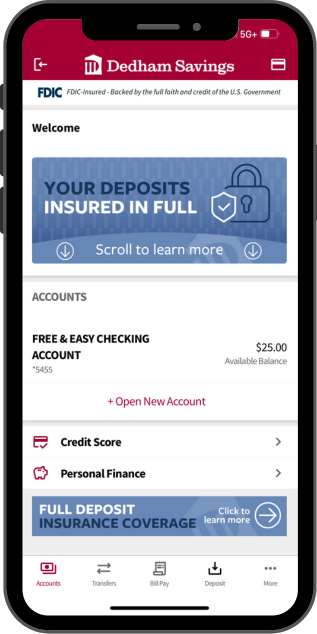

Mobile App

Now you can deposit checks in a snap. Literally. Just take a picture.

With Zelle®, you can easily send money in minutes to your friends and family, straight from your Checking account in the Dedham Savings mobile app. It doesn’t even matter where they bank.

Use this free service in Online Banking & Mobile Banking to view all your accounts in one location, create budgets, manage spending, set goals, and more.

Get instant access to your credit score, credit report, and credit monitoring.

With Debit Card Controls, you control when, where, and how your Debit Card can be used.

We’re so glad you’ll be joining the family. We’re here for your journey, and we can’t wait to support you along the way.

That’s okay. Take a look at our other account options. If you’ve got questions, just remember — we’re here with answers.

Keep things simple with unlimited ATM rebates, 24/7 online and mobile banking, and no monthly fees. Get all the benefits you need, without any of the hassle you don’t.

Choose the length of your CD term (anywhere from 3 months to 5 years) and enjoy our top interest rates the whole time.

Please note: You are about to leave the Dedham Savings website. Dedham Savings does not endorse or guarantee the products, information, or recommendations provided by linked sites and the Bank is not liable for any products or services advertised in these sites. The linked site may have a different privacy policy or provide less security than our website. We recommend you review these policies on the linked site. Thank you.