Money Market

Earn higher rates for higher balances.

With a Money Market1, it pays to be good at saving. The higher your balance, the higher your rate. You’ll also have easy access to your funds. And since your money stays liquid, it’s never tied up—it’s right there whenever you need it.

View our current rates to choose a Money Market Account. You can even open it online!

With this account, you can rest insured. Unlike most banks and credit unions, your funds are insured in full up to any amount.1

With a free ATM card, you can easily access your funds wherever you go. And speaking of deposits and withdrawals…

In-branch, via online or mobile banking, or at an ATM. Choose to save your money or spend it—this account works for you.

Get a great APY1, and watch it increase along with your savings.

1APY = Annual Percentage Yield. Rate subject to change without notice. Rate may change after the account is opened. Minimum deposit of $10 required to open account. $5.00 fee imposed every statement cycle if minimum daily balance for cycle falls below $1,000. Does not apply to Preferred Money Market Account or Premium Money Market Account. Fees may reduce earnings. Deposits are insured up to current FDIC (Federal Deposit Insurance Corporation) limits and by the DIF (Depositors Insurance Fund) for all additional balances, up to any amount.

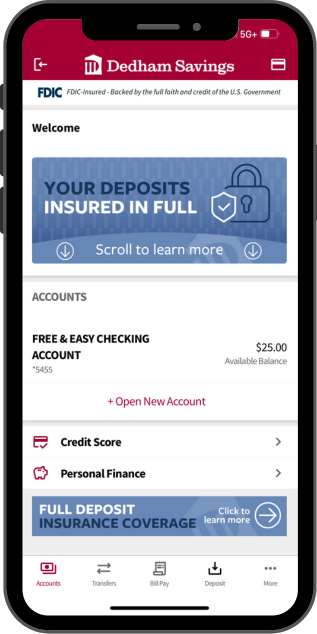

Mobile App

Now you can deposit checks in a snap. Literally. Just take a picture.

With Zelle®, you can easily send money in minutes to your friends and family, straight from your Checking account in the Dedham Savings mobile app. It doesn’t even matter where they bank.

Use this free service in Online Banking & Mobile Banking to view all your accounts in one location, create budgets, manage spending, set goals, and more.

Get instant access to your credit score, credit report, and credit monitoring.

With Debit Card Controls, you control when, where, and how your Debit Card can be used.

We’re so glad you’ll be joining the family. We’re here for your journey, and we can’t wait to support you along the way.

That’s okay. Take a look at our other account options. If you’ve got questions, just remember — we’re here with answers.

Choose the length of your CD term (anywhere from 3 months to 5 years) and enjoy our top interest rates the whole time.

Designed for first-time savers, this account helps you save faster. Way faster. At 5.00% APY1, you’ll reach those goals before you know it.

Please note: You are about to leave the Dedham Savings website. Dedham Savings does not endorse or guarantee the products, information, or recommendations provided by linked sites and the Bank is not liable for any products or services advertised in these sites. The linked site may have a different privacy policy or provide less security than our website. We recommend you review these policies on the linked site. Thank you.